Google Wallet has indeed made an appearance in India, but it seems there’s been a bit of a mix-up regarding its official launch. Here’s what’s happening:

Google Wallet App: Some users in India have been able to access Google Wallet before its official launch. The app is designed for contactless payments using credit/debit cards and requires smartphones with NFC support.

Local Integrations: The app includes local integrations, such as the ability to store boarding passes for Air India flights and track reward points for the State Bank of India’s Rewardz loyalty program.

Google Pay: It’s important to note that Google Wallet is a separate app from Google Pay, which offers UPI payment services in India. Google Wallet focuses on contactless payments, whereas Google Pay is for UPI-based transactions.

Official Statement: Google has clarified that the Wallet app has not yet officially launched in India. However, it seems that some users can download the app from the Google Play Store.

So, while Google Wallet is on the horizon for Indian users, the official rollout has yet to happen. Keep an eye out for any official announcements from Google for the full launch details.

What are the key features of Google Wallet?

Certainly! Google Wallet offers several key features that make it a versatile digital wallet. Here are the highlights:

Payments: Google Wallet allows you to add your payment cards (credit/debit cards) and make contactless payments anywhere Google Pay is accepted. Your personal payment details are kept safe and secure.

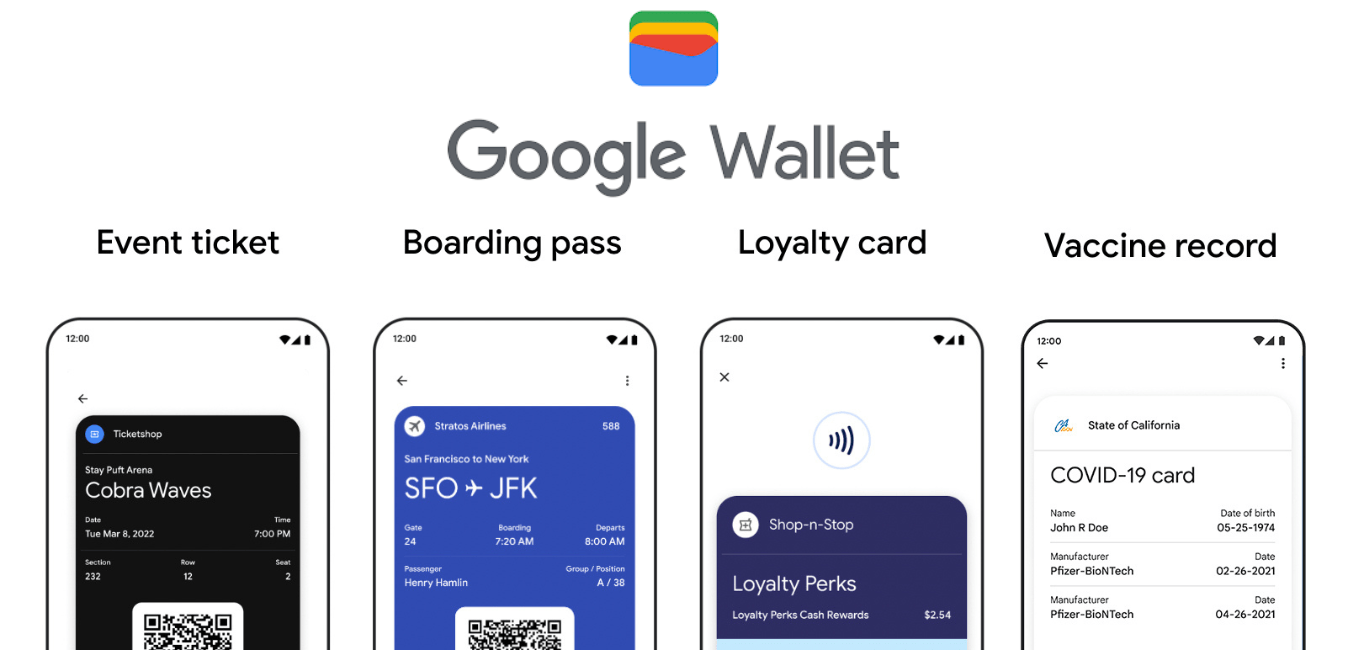

Travel & Transit: You can carry metro cards, plane tickets, and bus passes on your phone using Google Wallet. It also provides real-time updates on departure times and lets you load transit card balances directly in Google Maps.

Loyalty Cards: Never lose a loyalty card again! Add your loyalty and gift cards to Google Wallet, so you can save a little with every purchase.

Event Tickets: Google Wallet can store concert tickets, event passes, and more. It even surfaces your ticket on the day of the event, ensuring you won’t miss any part of the experience.

Digital Car Keys: Carry your digital car keys in Google Wallet for easy and secure access. Just hold your phone to your car door handle to unlock your vehicle. This feature is available on select BMW models, with more car models to come.

Health Records: Keep your vaccine card secure in Google Wallet to gain entry to places that require proof of vaccination.

Identity: Google Wallet makes proving your identity easier. You can add your driver’s license and student ID to the app. Digital driver’s licenses are currently available in Maryland, with more states to follow.

Security: Google Wallet prioritizes security. It offers advanced security features, including encrypted payment codes, 2-step verification, and privacy controls. Your personal information and money stay safe wherever you go.

Remember, Google Wallet is the default payment, ID, and transit pass app for most Android phones, replacing Google Pay. While Google Wallet supports various features, it’s essential to differentiate it from the original Google Pay app, which focuses on peer-to-peer payments. If you’re looking for a versatile digital wallet, Google Wallet has you covered!

How does Google Wallet compare to other digital wallets?

Google Wallet stands out among digital wallets with its comprehensive suite of features and integration into the Android ecosystem. Here’s how it compares to other digital wallets:

Google Wallet is designed to be a one-stop shop for various cards and passes, including payment cards, loyalty cards, transit passes, event tickets, and more. This versatility makes it comparable to the Apple Wallet, which offers similar functionalities.

Google Wallet is deeply integrated with other Google services, such as Google Maps, which can track receipts for reimbursements. This level of integration is unique to Google Wallet and enhances the user experience.

Google Wallet prioritizes security with advanced features like encrypted payment codes and 2-step verification. While other digital wallets also focus on security, Google’s infrastructure provides a robust and trusted platform.

Peer-to-Peer Payments: Unlike Google Pay, which is used for UPI-based transactions in India, Google Wallet does not support peer-to-peer payments. This is a significant difference from other digital wallets like Paytm, which allow for peer-to-peer transactions.

Legal Tender: It’s important to note that digital wallets like Paytm and Google Pay (UPI-based) are used to transact with physical currency withdrawn from a bank. In contrast, Google Wallet deals with digital versions of cards and passes rather than being a platform for legal tender like the digital rupee.

However, users looking for peer-to-peer payment options might prefer other digital wallets that offer this functionality. Google Wallet is ideal for those invested in the Google ecosystem and who value a comprehensive digital wallet experience.