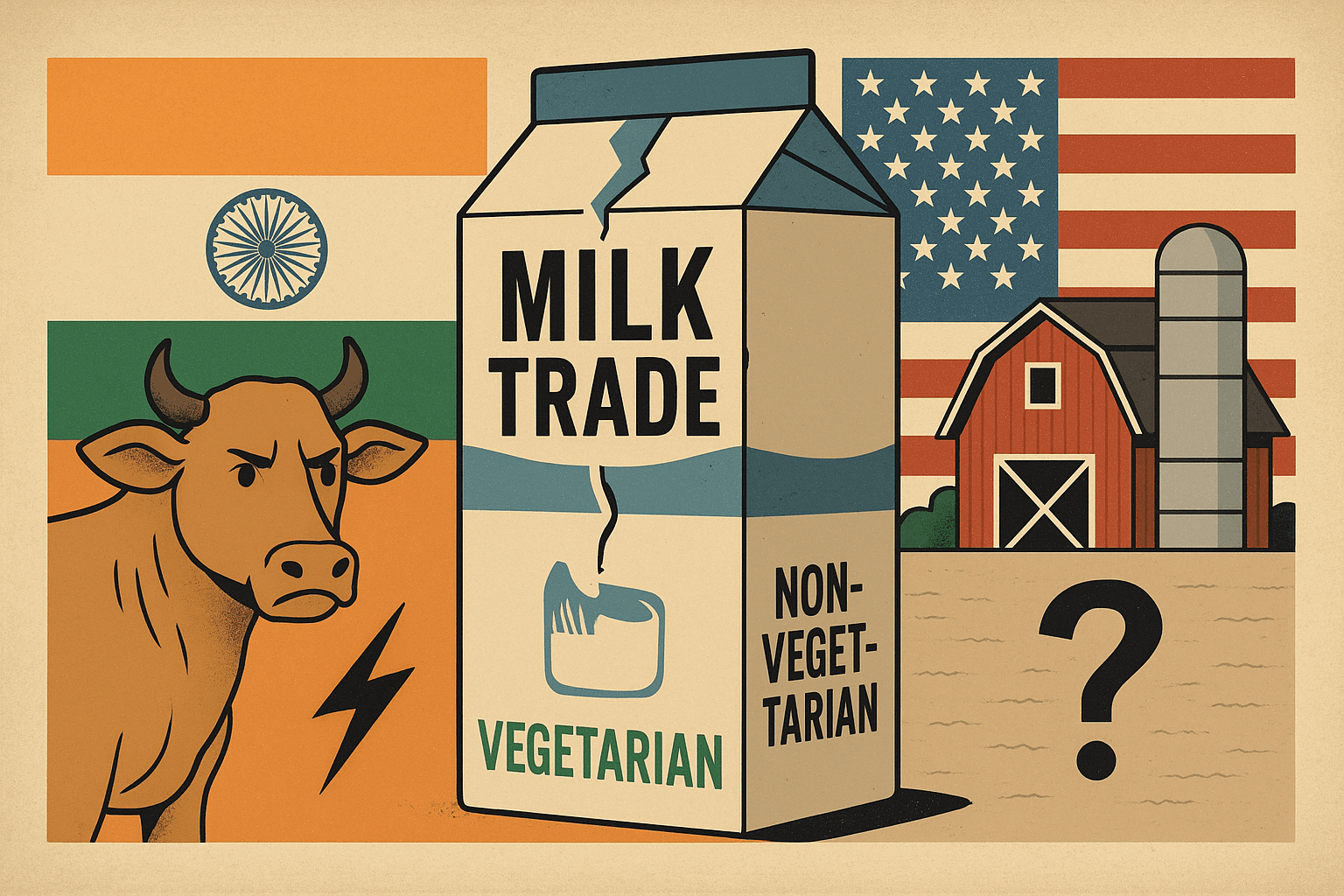

India has raised concerns over importing U.S. dairy products due to the practice of feeding cows animal-based substances like meat, blood, and bone meal. This clashes with India’s cultural and religious beliefs, where milk is considered sacred and vegetarian. The term “non-veg milk” has sparked controversy, as many Indians view such dairy as impure and unsuitable for consumption or religious rituals.

Table of Contents

- The Cultural Significance of Dairy in India

- U.S. Dairy Practices and the “Non-Veg Milk” Label

- Economic Stakes: India’s Dairy Sector and the Threat of U.S. Imports

- The Trade Impasse: A Clash of Priorities

- Amul’s Role and the Broader Dairy Trade Context

- Challenges and Potential Resolutions

- Broader Implications for India-US Trade Relations

This issue has become a major roadblock in India-U.S. trade negotiations, which aim to boost bilateral commerce to $500 billion by 2030. India insists on strict certification for dairy imports, reflecting its commitment to protecting cultural values and small farmers’ business.

The Cultural Significance of Dairy in India

In India, milk is seen as pure and holy. Many people believe it should only come from cows that eat vegetarian food like grass and grains. But in the U.S., cows are often fed things like meat and bone meal to increase milk production. This kind of milk is called “non-veg milk” in India.

In India cow is considered like mother, so they worship her and the things related to her. considered “satvik” (pure), dairy aligns with vegetarian principles, especially significant as 38% of India’s 1.4 billion people are vegetarian. Cows, considered sacred in Hinduism.

Ajay Srivastava from the Global Trade Research Institute explained it simply:

“Imagine eating butter made from the milk of a cow that was fed meat and blood from another cow. India may never allow that.” To protect people’s beliefs, India’s food safety authority (FSSAI) suggested in 2021-22 that such milk products should have a “non-veg” label. This shows how serious the issue is.

For India, milk is more than just food; it’s part of religion, tradition, and daily life. That’s why this issue has become a big problem in trade talks with the U.S. It shows that when countries do business, they also need to respect each other’s cultures and values.

U.S. Dairy Practices and the “Non-Veg Milk” Label

In the United States, dairy cows are often fed animal-based products like meat, bone meal, fish, and poultry waste to increase milk production and reduce costs. A 2004 report even mentioned that cattle feed could include parts of pigs, chickens, horses, and sometimes cats or dogs, along with blood and fat from animals. Although U.S. rules ban feeding cows parts of other cows to prevent diseases like mad cow disease, using other animal by-products is still common and considered safe by American standards.

However, these practices go against India’s cultural and religious beliefs. In India, cows are sacred, and milk is seen as pure and vegetarian. To protect these values, India’s Department of Animal Husbandry requires strict certification for imported dairy. It states that cows must never be fed meat, bone meal, or blood-based feed, only milk and milk products are allowed.

This rule is based on both cultural sensitivity and food safety. But the U.S. has criticized it at the World Trade Organization (WTO), calling it an unfair trade barrier. The U.S. also pointed out that India’s updated dairy rules from November 2024 don’t clearly mention vegetarian feed, which creates confusion in trade discussions.

Economic Stakes: India’s Dairy Sector and the Threat of U.S. Imports

India’s dairy sector is a cornerstone of its rural economy, contributing 2.5–3% to the national Gross Value Added (GVA), equivalent to ₹7.5–9 lakh crore ($90–108 billion). With a milk production of 239.3 million metric tons in 2023–24, India accounts for nearly a quarter of global milk production and supports over 80 million smallholder farmers, many of whom rely on 1–3 cows for their livelihoods. Cooperatives like Amul, part of the Gujarat Cooperative Milk Marketing Federation (GCMMF), have been instrumental in this success, empowering farmers through the “Anand Pattern” and transforming India into a dairy powerhouse.

Opening India’s dairy market to U.S. imports could lower domestic milk prices by 15%, causing ₹1.03 lakh crore ($12.4 billion) in losses for Indian farmers. With over 80 million small-scale producers at risk, experts and farmers warn that cheap imports could severely damage India’s rural dairy economy.

India protects its dairy industry with high tariffs—30% on cheese, 40% on butter, and 60% on milk powder—making foreign imports too costly. These tariffs and strict rules help safeguard local farmers and cultural values. The U.S. says these limits are unfair and wants more access to India’s market.

The Trade Impasse: A Clash of Priorities

The “non-veg milk” controversy has emerged as a major hurdle in India-US trade talks, with a looming August 1, 2025, deadline set by U.S. President Donald Trump, threatening higher tariffs on Indian goods if unresolved. Both nations aim to boost bilateral trade to $500 billion by 2030, but dairy remains contentious. India’s refusal to import U.S. dairy from cows fed animal-based feed, deemed “non-veg,” stems from cultural, religious, and economic imperatives, protecting its 80 million dairy farmers.

A senior Indian official called dairy a “non-negotiable red line.” The U.S., labeling India’s stance protectionist, challenges its strict vegetarian feed certification at the WTO, asserting its dairy’s safety. Indian sentiments on X, from user’s like @ThePerilousGirl and @Devinder_Sharma, highlight cultural resistance and political risks, especially with upcoming state elections. This clash underscores the challenge of aligning economic ambitions with India’s cultural values, stalling broader trade progress.

Amul’s Role and the Broader Dairy Trade Context

Amul, India’s largest dairy cooperative, exemplifies the strength of India’s dairy sector. With an annual turnover exceeding $10 billion and exports to over 50 countries, Amul has made significant inroads into the U.S. market, launching fresh milk in 2024 in partnership with the Michigan Milk Producers Association (MMPA). This move targets the Indian diaspora and Asian communities but also positions Amul to compete with U.S. brands in a market with declining milk consumption. Amul’s success highlights India’s ability to compete globally, yet its domestic market remains heavily protected to preserve the livelihoods of millions of farmers.

In contrast, U.S. dairy exports to India, primarily lactose and whey protein, face high tariffs (30–60%) and cultural barriers. The “non-veg milk” issue exacerbates this divide, as India’s insistence on vegetarian feed certification complicates U.S. market access. While Amul’s exports to the U.S. are modest (2% of its turnover), they demonstrate India’s growing dairy influence, which may intensify U.S. pressure for reciprocal market access.

Challenges and Potential Resolutions

The “non-veg milk” issue creates tension between India’s cultural values and trade with countries like the U.S. In India, milk from cows fed animal-based products is unacceptable due to religious and vegetarian beliefs. Testing milk to confirm if cows were fed meat or bone meal is costly and hard to do on a large scale. U.S. exporters say the milk is still safe to consume, but India insists on strict rules to ensure purity.

One solution could be U.S. farmers using vegetarian feed for some cows meant for India’s market, though this would raise costs and need strong checks to ensure compliance. Another option is allowing U.S. dairy in India with clear “non-veg” labels, as suggested by India’s food authority, letting buyers choose. But this might upset religious and vegetarian groups. Alternatively, India and the U.S. could focus on trading non-dairy farm products to avoid the milk issue while boosting trade. With India’s focus on protecting rural livelihoods and cultural values, it’s unlikely to change its stance soon, making compromise tricky.

Broader Implications for India-US Trade Relations

The “non-veg milk” controversy is emblematic of the broader challenges in India-US trade relations, where economic ambitions intersect with cultural and political realities. India’s protectionist dairy policies reflect its commitment to its farmers and cultural heritage, while the U.S. seeks to capitalize on India’s massive consumer market. The dispute highlights the difficulty of aligning divergent agricultural practices and consumer expectations in global trade. As @shashank_ssj noted on X, “Surprising, such milk exists. Glad India is standing its ground.” This sentiment reflects national pride in India’s dairy self-sufficiency and cultural identity.

Beyond dairy, the controversy underscores the need for trade agreements to account for non-economic factors like faith and tradition. India’s firm stance may strengthen its negotiating position in other areas, such as electronics or pharmaceuticals, where it seeks greater U.S. market access. However, prolonged deadlock risks escalating tensions, especially with Trump’s tariff threats looming.

India has imposed high tariffs on dairy imports to protect its farmers. When agricultural crops don’t yield good profits, many farmers shift to animal husbandry for better income.

If foreign dairy products enter the Indian market, it could severely impact small-scale, home-run dairy businesses. In the U.S., dairy farming is driven by commercial goals, and cows are often fed meat and blood-based products to boost milk production. In contrast, in India, the cow is considered a symbol of purity and is fed only vegetarian food like green grass and natural plant-based items. For Indian farmers, dairy is not just commerce—it’s a livelihood rooted in tradition and values, not in maximizing profit.

A resolution needs creative solutions that respect India’s cultural beliefs and meet U.S. economic goals. Until then, the “non-veg milk” issue remains a significant obstacle in trade talks, highlighting the challenges of balancing global business interests with local traditions and values in international agreements.

Do share thoughts on it what you think on it…..